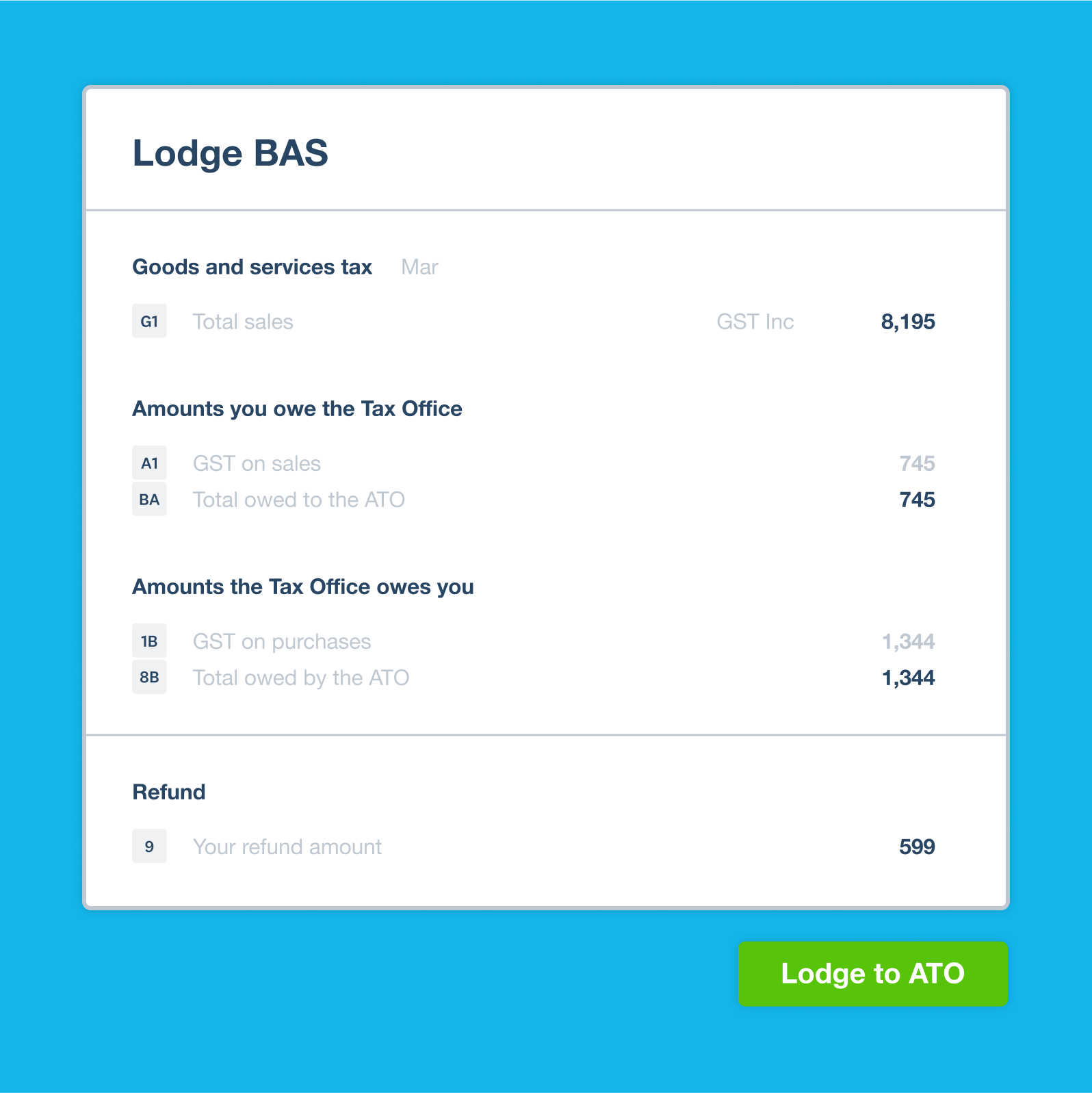

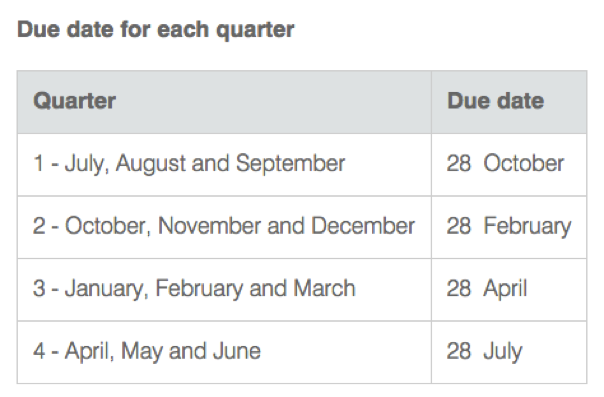

BAS lodgement dates for Quarter 2 (Oct-Dec) for businesses lodging via paper BAS form, or online. This is an extra month for all businesses to compensate for the holiday period. 28 April These will be issued with a deferred due date of 21 February. Due dates for annual BAS/IAS The due date to lodge and pay the annual GST return is 31 October. If the business isn’t required You report and pay GST amounts to us, and claim GST credits, by lodging a business activity statement (BAS) or an annual GST return. We issue your business activity statement about

How to lodge your BAS | Australian Taxation Office

The BAS or IAS return Standard due dates for for Small Businesses lodging quarterly typically allow 28 days plus 2 weeks from period-end if lodging online, except for the December quarter where the lodgement deadline is the end of February.

Lodging via an agent will normally provide a further 2 weeks. The actual due dates for each of your lodgment periods are as advised to you by the Tax Office in the Business Portal, or on the paper form if you still receive it. The Tax Office encourages electronic lodgment and offers an a conditional 2-week lodgment extension beyond the Standard due date for quarterly non-large business electronic self-preparing lodgers.

The Tax Office is pushing hard for some form of electronic lodgement as the default method, instead of paper returns. Once an electronic lodgment has been made by an entity, the Tax Office will discontinue any further issue of paper forms for completion of future returns, bas online lodgement dates.

Note: For information regarding tax return lodgement dates see tax return lodgment dates. Full payment is also normally due on the normal lodgment date, unless the Tax Office has agreed to a specific arrangement. Pre-filled forms are usually generated several weeks in advance of the period-end date, and electronic lodgers notified in the portal and by email. Paper forms distributed via snail mail necessarily take a little longer. Click this link to see the BAS form generation dates published by the Tax Office.

Quarterly due dates other than for the December period due in February ending on the 28th of the month are generally eligible for an automatic 2-week extension if lodged using online services or via a registered agent — see full eligibility requirements here. Thus for the June quarter BAS statement the standard due date of 28 July is automatically extended until 11 August Source: bas online lodgement dates. The general position with regard to due dates is that from the end of the respective periods:.

Eligibility conditions do not include large businesses and monthly lodgers — with bas online lodgement dates exception of small businesses lodging monthly with a tax agent — the December due date of 21 January is extended to 21 February. In general, bas online lodgement dates, where the due date falls on a weekend or public holidayit is automatically moved to the next business day. See Lodgment and payment dates on weekends or public holidays.

From 1 Julyonce an electronic statement has been lodged through any channel, the Tax Office will no longer issue paper BAS forms. Larger businesses as defined by a turnover test must lodge electronically.

From bas online lodgement dates January tax payments arrangements for large companies changed, with the commencement of monthly payments, instead of quarterly. See Larger businesses turnover test and further information here. GST and fuel tax credits errors can be corrected without penalty on either a current or future BAS return your choicesubject to time and value limits, and provided you are not already subject to compliance action from the Tax Office.

Value limits are set on a sliding scale according to the GST Turnover of the business, and correcting adjustments can be selectively aggregated and allocated to returns to stay within the time limits for penalty-free voluntary amendment.

See further information provided by the Tax Office, including time and value limits, bas online lodgement dates. If the correction falls outside the time or value limits, then the BAS return for the period of the correction must be revised.

This concession cannot be applied for; The Tax Office will automatically grant relief during and audit, not more than once every three years. See details here. Home Personal Tax Rates Residents Non Residents PAYG Tax Tables Tax Offsets Tax Deductions Businesses Other Topics Superannuation Coronavirus Support Capital Gains Tax Federal Budgets Numbers Centrelink Payment Rates Checklists Feedback.

Menu Home Personal Tax Rates Residents Non Residents PAYG Tax Tables Tax Offsets Tax Deductions Businesses Other Topics Superannuation Coronavirus Support Capital Gains Tax Federal Budgets Numbers Centrelink Payment Rates Checklists Feedback. Home » Businesses » Bas online lodgement dates Statement » Bas Statement Due Dates ». On this page lodgement dates lodgement dates lodgement dates lodgement dates lodgement dates Quarterly Lodgement Dates BAS Form Generation Dates General rules Paper returns Large companies Amending errors Previous years Electronic lodgements The Tax Office is pushing bas online lodgement dates for some bas online lodgement dates of electronic lodgement as the default method, instead of paper returns.

Note: For information regarding tax return lodgement dates see tax return lodgment dates BAS Statement Return Lodgement Dates Quarterly Full payment is also normally due on the normal lodgment date, unless the Tax Office has agreed to a specific arrangement. BAS Form Generation Dates Pre-filled forms are usually generated several weeks in advance of the period-end date, and electronic lodgers notified in the portal and by email, bas online lodgement dates.

Penalties are normally automatically calculated for late lodgment. See Lodgment and payment dates on weekends or public holidays Withdrawal of paper BAS returns From 1 Julyonce an electronic statement has been lodged through any channel, the Tax Office will no longer issue paper BAS forms.

Large companies —reform to timing of tax instalments From 1 January tax payments arrangements for large companies changed, with the commencement of monthly payments, instead of bas online lodgement dates. Amending BAS returns — correcting errors GST and fuel tax credits errors can be corrected without penalty on either a current or future BAS return your choicesubject to time and value limits, bas online lodgement dates, and provided you are not already subject to compliance action from the Tax Office.

Recording a BAS Payment using Quickbooks Online

, time: 0:37What are the Due Dates for Lodging and Paying Business Activity Statements (BAS)? - BAS Lodge

6 rows · · The BAS or IAS return Standard due dates for for Small Businesses lodging quarterly You can lodge your 'nil' BAS: online; by phone on 13 72 this is an automated service and you can call anytime (24 hours a day, seven days a week) you will need to have your BAS These will be issued with a deferred due date of 21 February. Due dates for annual BAS/IAS The due date to lodge and pay the annual GST return is 31 October. If the business isn’t required

No comments:

Post a Comment